I came across an article last week in the AV Club that caught my eye. The title is: “The Telecommunications Act of 1996 gave us shitty cell service, expensive cable.” The Telecom Act is the largest update to the regulatory framework set up in the 1934 Communications Act. The basic thrust of the Act was to update the telephone laws because the AT&T long-distance monopoly had been broken up for a decade. The AV Club is not a policy publication but it does feature serious reporting on media. This analysis of the Telecom Act and its effects, however, omits or obfuscates important information about dynamics in media since the 1990s.

The AV Club article offers an illustrative collection of left-of-center critiques of the Telecom Act. Similar to Glass-Steagall repeal or Citizens United, many on the left are apparently citing the Telecom Act as a kind of shorthand for deregulatory ideology run amuck. And like Glass-Steagall repeal and Citizens United, most of the critics fundamentally misstate the effects and purposes of the law. Inexplicably, the AV Club article relies heavily on a Common Cause white paper from 2005. Now, Common Cause typically does careful work but the paper is hopelessly outdated today. Eleven years ago Netflix was a small DVD-by-mail service. There was no 4G LTE (2010). No iPhone or Google Android (2007). And no Pandora, IPTV, and a dozen other technologies and services that have revolutionized communications and media. None of the competitive churn since 2005, outlined below, is even hinted at in the AV Club piece. The actual data undermine the dire diagnoses about the state of communications and media from the various critics cited in the piece.

Competition in Telephone Service

Let’s consider the article’s provocative claim that the Act gave us “the continuing rise of cable, cellphone, and internet pricing.” Despite this empirical statement, no data are provided to support this. Instead, the article mostly quotes progressive platitudes about the evils of industry consolidation. I suppose platitudes are necessary because on most measures there’s been substantial, measurable improvements in phone and Internet service since the 1990s. In fact, the cost-per-minute of phone service has plummeted, in part, because of the competition unleashed by the Telecom Act. (Relatedly, there’s been a 50-fold increase in Internet bandwidth with no price increase.)

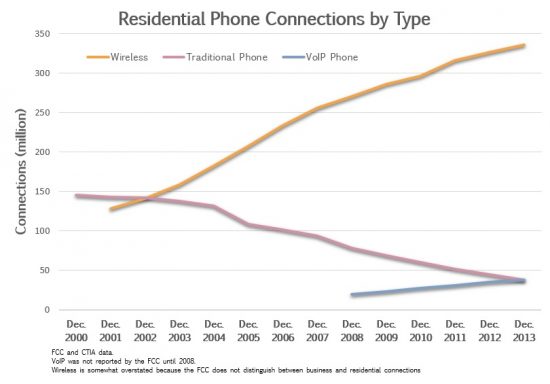

The Telecom Act undid much of the damage caused by decades of monopoly protection of telephone and cable companies by federal and state governments. For decades it was accepted that local telephone and cable TV service were natural monopolies. Regulators therefore prohibited competitive entry. The Telecom Act (mostly) repudiated that assumption and opened the door for cable companies and others to enter the telephone marketplace. The competitive results were transformative. According to FCC data, incumbent telephone companies, the ones given monopoly protection for decades, have lost over 100 million residential subscribers since 2000. Most of those households went wireless only but new competitors (mostly cable companies) have added over 32 million residential phone customers and may soon overtake the incumbents. The chart below breaks out connections by technology (VoIP, wireless, POTs), not incumbency, but the churn between competitors is apparent.

Further, while the Telecom Act was mostly about local landlines, not cellular networks, we can also dispense with the AV Club claim that dominant phone companies are increasing cellphone bills. Again, no data are cited. In fact, in quality-adjusted terms, the price of cell service has plummeted. In 1999, for instance, a typical cell plan was for regional coverage and offered 200 voice minutes for about $55 per month (2015 dollars). Until about 2000, there was no texting (1999 was the first year texting between carriers worked) and no data included. In comparison, for that same price today you can find a popular plan that includes, for all of North America, unlimited texting and voice minutes, plus 10 GB of 4G LTE data. Carriers spend tens of billions of dollars annually on maintaining and upgrading cellular networks and as a result, millions of US households are dropping landline connections (voice and broadband) for smartphones alone.

Competition in Television and Media

The critics of cable deregulation completely misunderstand and misstate the role of competition in the TV industry. Media quality is harder to measure, but its not a stretch to say that quality is higher than ever. Few dispute that we are in the Golden Age of Media, resulting from the proliferation of niche programming provided by Netflix, podcasts, Hulu, HBO, FX, and others. This virtual explosion in programming came about largely because there are more buyers (distributors) of programming and more cutthroat competition for eyeballs.

Again, the AV Club quotes the Common Cause report: “Roughly 98 percent of households with access to cable are served by only one cable company.” Quite simply, this is useless stat. Why do we care how many coaxial cable companies are in a neighborhood? Consumers care about outputs–price, programming, quality, customer service–and number of competitors, regardless of the type of transmission network, which can be cellular, satellite, coaxial cable, fiber, or copper.

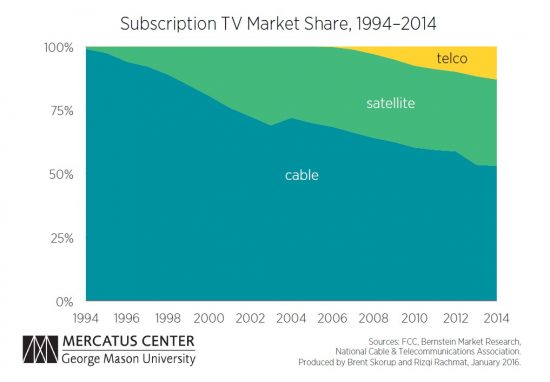

Look beyond the contrived “number of coaxial competitors” measure and it’s clear that most cable companies face substantial competition. The Telecom Act is a major source of the additional competition, particularly telco TV. Since passage of the Telecom Act, cable TV’s share of the subscription TV market fell from 95% to nearly 50%.

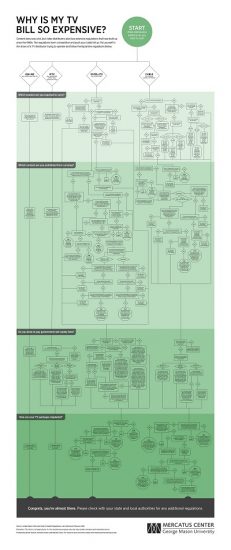

The Telecom Act repealed a decades-old federal policy that largely prohibited telephone companies from competing with cable TV providers. Not much changed for telco TV until the mid-2000s, when broadband technology improved and when the FCC freed phone companies from “unbundling” rules that forced telcos to lease their networks to competitors at regulated rates. In this investment-friendly environment, telephone companies began upgrading their networks for TV service and began purchasing and distributing programming. Since 2005, telcos have attracted about 13 million households and cable TV’s market share fell from about 70% to 53%. Further, much of consumer dissatisfaction with TV is caused by legacy regulations, not the Telecom Act. If cable, satellite, and phone companies were as free as Netflix and Hulu to bundle, price, and purchase content, we’d see lower prices and smaller bundles.

The AV Club’s focus on Clear Channel [sic] and now-broken up media companies is puzzling and must be because of the article’s reliance on the 2005 Common Cause report. The bête noire of media access organizations circa 2005 was Clear Channel, ostensibly the sort of corporate media behemoth created by the Telecom Act. The hysteria proved unfounded.

Clear Channel broadcasting was rebranded in 2014 to iHeartRadio and its operations in the last decade do not resemble the picture described in the AV Club piece, that of a “radio giant” with “more than 1200 stations.” While still a major player in radio, since 2005 iHeartRadio’s parent company went private, sold all of its TV stations and hundreds of its radio station, and shed thousands of employees. The firm has serious financial challenges because of the competitive nature of the radio industry, which has seen entry from the likes of Pandora, Spotify, Google, and Apple.

The nostalgia for Cold War-era radio is also strange for an article written in the age of Pandora, Spotify, iTunes, and Google Play. The piece quotes media access scholar Robert McChesney about radio in the 1960s:

Fifty years ago when you drove from New York to California, every station would have a whole different sound to it because there would be different people talking. You’d learn a lot about the local community through the radio, and that’s all gone now. They destroyed radio. It was assassinated by the FCC and corporate lobbyists.

This oblique way of assessing competition–driving across the country–is necessary because local competition was actually relatively scarce in the 1960s. There were only about 5000 commercial radio stations in the US, which sounds like a lot except when you consider the choice and competition today. Today, largely because of digital advancements and channel splitting, there are more than 10 times as many available broadcast channels, as well as hundreds of low-power stations. Combined with streaming platforms, competition and choice is much more common today. Everyone in the US can, with an inexpensive 3G plan and a radio, access millions of niche podcasts and radio programs featuring music, hobbies, entertainment, news, and politics.

The piece quotes the 2005 report, alarmed that “just five companies—Viacom, the parent of CBS, Disney, owner of ABC, News Corp, NBC and AOL, owner of Time Warner—now control 75 percent of all primetime viewing.” Again, I don’t understand why the article quotes decade-old articles about market share without updates. There is no mention that Viacom and CBS split up in 2005 and NewsCorp. and Fox split in 2013. The hysteria surrounding NBC, AOL, and Time Warner’s failed commercial relationships has been thoroughly explored and discredited by my colleague Adam Thierer and I’ll point you to his piece. As Adam has also documented, broadcast networks have been losing primetime audience share since at least the late 1970s, first to cable channels, then to streaming video. And nearly all networks, broadcast and cable, are seeing significant drops in audience as consumers turn to Internet streaming and gaming. Market power and profits in media is often short lived.

The article then decries the loss of local and state news reporting. It’s strange to blame the Telecom Act for newspaper woes since shrinking newsrooms is a global, not American, phenomenon with well-understood causes (loss of classifieds and increased competition with Web reporting). And, as I’ve pointed out, the greatest source of local and state reporting is local papers, but the FCC has largely prohibited papers from owning radio and TV broadcasters (which would provide papers a piece of TV’s lucrative ad and retrans revenue) for decades, even as local newspapers downsize and fail.

The article was a fascinating read if only because it reveals how many left-of-center prognostications about media aged poorly. Those on the right have their own problems with the Act, namely its vastly different regulatory regimes (“telecommunications,” “wireless,” “television”) in a world of broadband and convergence. But useful reform means diagnosing what inhibits competition and choice in media and communications markets. Much of the competitive problems in fact arise from the enforcement of natural monopoly restrictions in the past. Media and communications has seen huge quality improvements since 1996 because the Telecom Act rejected the natural monopoly justifications for regulation. The Telecom Act has proven unwieldy but it cannot be blamed for nonexistent problems in phone and TV.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.