The day many had expected is finally here. This Reuters headline says it all: [Senators seek crackdown on “Bitcoin” currency](http://www.baltimoresun.com/business/sns-rt-us-financial-bitcoitre7573t3-20110608,0,1767151.story).

The day many had expected is finally here. This Reuters headline says it all: [Senators seek crackdown on “Bitcoin” currency](http://www.baltimoresun.com/business/sns-rt-us-financial-bitcoitre7573t3-20110608,0,1767151.story).

The main target of Sens. Chuck Schumer and Joe Manchin is Silk Road–the [online illicit drug bazaar](http://gawker.com/5805928/the-underground-website-where-you-can-buy-any-drug-imaginable) run via the TOR network–but bitcoin, the currency of choice on Silk Road, is also in their sights. (Also, Sens. Roy Blunt and Claire McCaskill [are also getting in on the action.](http://www.fox2now.com/news/ktvi-missouri-lawmakers-want-to-shut-down-drug-dealing-website-20110607,0,2162224.story)) In [a recent letter](http://pastebin.com/VurF7dgr) Schimer and Manchin have asked the DOJ and DEA to shut down Silk Road, and “seize” the website’s domain. More to the point, in his press conference, [which you can watch here](http://www.wpix.com/videobeta/f76e263d-8ab3-4028-bf42-1b18c3eb9b5d/News/RAW-VIDEO-Sen-Schumer-On-Silk-Road), Schumer said that bitcoin is “an online form of money laundering used to disguise the source of money, and to disguise who’s both selling and buying the drug.”

As the DOJ and DEA plan a response and this issue develops, I though I’d offer some initial thoughts:

– Bitcoin is digital cash, and like any form of cash, it can be used for good or for ill. Because, like all cash, it is largely anonymous, it will be used by persons looking to evade official scrutiny. This could be contributing anonymously to unpopular causes like Wikileaks, but it could also mean buying drugs online. We don’t ban hard to trace paper cash because we understand that there’s nothing inherently bad about it; it’s what people do with it that’s can be problematic. Bitcoin should be treated the same way.

That said about what I think ought to be, what’s really interesting is what will be regardless of normative values. That is, can Silk Road and bitcoin “cracked down”?

– The federal government is no doubt going to go after Silk Road. This sets up another “natural experiment” like [the one presented by LulzSec taking bitcoin donations](http://techliberation.com/2011/06/03/bitcoin-silk-road-and-lulzsec-oh-my/). Given that the site exists as a [.onion an anonymous hidden service](http://en.wikipedia.org/wiki/.onion) via TOR, will the feds be able to find who’s behind it and shut it down? We’ll see. They certainly won’t be able to “seize the domain” as Schumer and Manchin’s letter suggests. If a year from now the site is still operating, will we be able to say that government does not “[possess any methods of enforcement we have true reason to fear.](http://www.wired.com/wired/if/declaration/)”

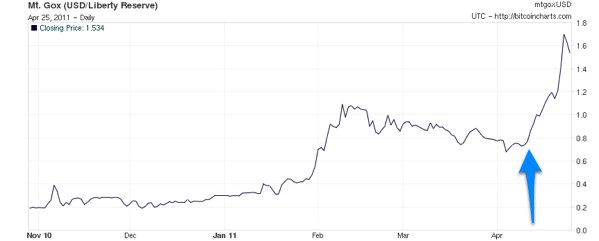

– If the federal government seeks to go after bitcoin, it won’t be able to take down the network. That’s just impossible as far as I can tell. The weakest link in the bitcoin ecosystem, however, are the exchanges, like Mt Gox. These allow you to trade your bitcoins for dollars and vice versa. At this point, there’s not a lot you can buy with bitcoins, so the ability to trade them to a widely accepted currency is important.

According to Gavin Andresen, the lead developer of the bitcoin project, Mt Gox “is careful to comply with all anti-money-laundering laws and regulations.” I’d love to know more about this. As far as I can tell, we know very little about who runs Mt Gox and how they comply with the law.

– Even if the federal government is able to shut down Silk Road and exchanges like Mt Gox, we will quickly see others take their place. Silk Road will be supplanted by another anonymart ([to use Kevin Kelly’s phrase](http://www.kk.org/thetechnium/archives/2011/06/the_stealthy_an.php)), and we’ll see a replay of the drug war we know too well from meatspace. As for exchanges, we’ll see new ones pop up, likely in jurisdictions with liberal banking laws, and it will be interesting to see if Congress tries to make it illegal for financial institutions and payment processors to deal with them, just as they’ve made it illegal to deal with offshore online casinos. What I hope we’ll see emerge is a properly licensed and legally compliant domestic exchange that is as committed to fighting money laundering as Citibank. That would certainly help test bitcoin’s legality. This [great paper by Reuben Grinberg](http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1817857) that gives me hope that, for now at least, there’s nothing inherently illegal about trading bitcoins.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.