Industrial Policy is a red-hot topic once again with many policymakers and pundits of different ideological leanings lining up to support ambitious new state planning for various sectors — especially 5G, artificial intelligence, and semiconductors. A remarkably bipartisan array of people and organizations are advocating for government to flex its muscle and begin directing more spending and decision-making in various technological areas. They all suggest some sort of big plan is needed, and it is not uncommon for these industrial policy advocates to suggest that hundreds of billions will need to be spent in pursuit of those plans.

Others disagree, however, and I’ll be using this post to catalog some of their concerns on an ongoing basis. Some of the criticisms listed here are portions of longer essays, many of which highlight other types of steps that governments can take to spur innovative activities. Industrial policy is an amorphous term with many definitions of a broad spectrum of possible proposals. Almost everyone believes in some form of industrial policy if you define the term broadly enough. But, as I argued in a September 2020 essay “On Defining ‘Industrial Policy‘,” I believe it is important to narrow the focus of the term such that we can continue to use the term in a rational way. Toward that end, I believe a proper understanding of industrial policy refers to targeted and directed efforts to plan for specific future industrial outputs and outcomes.

The collection of essays below is merely an attempt to highlight some of the general concerns about the most ambitious calls for expansive industrial policy, many of which harken back to debates I was covering in the late 1980s and early 1990s, when I first started a career in policy analysis. During that time, Japan and South Korea were the primary countries of concern cited by industrial policy advocates. Today, it is China’s growing economic standing that is fueling calls for ambitious state-led targeted investments in “strategic” sectors and technologies. To a lesser extent, grandiose European industrial policy proposals are also prompting new US counter-proposals.

All this activity is what has given rise to many of the critiques listed below. If you have suggestions for other essays I might add to this list, please feel free to pass them along. FYI: There’s no particular order here.

Scott Lincicome and Huan Zhu, “Questioning Industrial Policy: Why Government Manufacturing Plans Are Ineffective and Unnecessary,” Cato Institute Working Paper, June 16, 2021.

[I]ndustrial policy – properly defined – has an extensive and underwhelming history

in the United States, featuring high costs (seen and unseen), failed objectives, and political manipulation. Surely, not every U.S. industrial policy effort has ended in disaster, but facts here and abroad argue strongly against new government efforts to boost “critical” industries and workers and thereby fix alleged market failures. Such efforts warrant intense skepticism – skepticism that today is unfortunately in short supply.

Adam Thierer, “Industrial Policy as Casino Economics,” The Hill, July 12, 2021.

While some government investments will always be necessary, policymakers engaging in casino economics means bad industrial policy bets and taxpayer money squandered on risky ventures best made by private actors. We need to keep Uncle Sam’s gambling habits in check.

Adam Thierer, “Thoughts on the America COMPETES Act: The Most Corporatist & Wasteful Industrial Policy Ever,” Technology Liberation Front, January 26, 2022.

As far as industrial policy measures go, the COMPETES Act is one of the most ambitious and expensive central planning efforts in American history. It represents the triumph of top-down, corporatist, techno-mercantilist thinking over a more sensible innovation policy rooted in bottom-up competition, entrepreneurialism, private investment, and free trade.

Adam Thierer & Connor Haaland, “Does the US Need a More Targeted Industrial Policy for AI & High-Tech?” Mercatus Center at George Mason University, Special Study, November 2021.

This paper considers how both the recent history of high-tech industrial policy efforts at the national and international level—as well as some state and local economic development efforts in the United States—might better inform the wisdom of proposed efforts for AI or other high-tech sectors. That history is spotted with some limited successes alongside a long string of costly failures. We explore the reasons for those failures and recommend that the US refocus on the policy prerequisites that helped give rise to the computing and internet revolutions: a more generalized approach to economic development rooted in light-touch regulation and taxation of emerging technology.

Samuel Gregg, “Can America Build A Broad-Based Economy?” Law & Liberty, March 1, 2022

Of course, if a government decides to put enough money and resources behind a given industrial policy, it will likely produce some results. Yet the same is true of the gambler. If she stays in the casino long enough and spends enough money, she will win a few hands of cards. But the odds are that she will also lose a great deal of money, especially if she is as inept a gambler as the government is maladroit at identifying industry trends or entrepreneurial opportunities. Moreover, just as a compulsive gambler’s behavior will have numerous negative effects on her family’s well-being, so too does industrial policy risk inflicting wider damage upon a nation’s economy and political system. The harms range from gross misallocations of resources to the rampant cronyism and rent-seeking that seems inseparable from industrial policy (which, I again note, its advocates studiously avoid discussing), to name just a few.

Phil Gramm & Mike Solon, “Peace Through Strength Requires Economic Freedom,” Wall Street Journal, March 1, 2022.

The America Competes Act is the House’s effort to outdo the Chinese Communist Party’s latest five-year plan. The 2,900-page bill would make an old Soviet commissar blush. [. . . ] America’s success in the world economy has never depended on industrial policy or government subsidies. It has come from the relative absence of government planning and subsidies. This is hardly news. The U.S. government provided support for the efforts of Samuel Langley, the greatest aviation expert of the 1890s, in his effort to make America first in powered flight. His manned Aerodrome flopped into the Potomac River. It was the Wright brothers, two unsubsidized but determined bicycle makers from Dayton, Ohio, who flew at Kitty Hawk, N.C., and changed the world.

Scott Lincicome, “Moving Fast and Breaking Things,” Capitolism, February 2, 2022.

Adam Thierer, “The Coming Industrial Policy Hangover,” The Hill, February 16, 2022.

Podcast: “What’s Wrong with Industrial Policy,” Hold These Truths with Rep. Dan Crenshaw, February 16, 2022.

Tad DeHaven and Adam Thierer, “The Military-Industrial Complex Offers a Cautionary Tale for Industrial Policy Planning,” Discourse, March 25, 2022.

Wayne Crews, “What To Do Instead Of The America COMPETES Act,” Forbes, February 2, 2022.

All this spending and expansion of the federal government, atop which our leaders would lay the America COMPETES Act and doubtless its own accompanying guidebook, has massive, ignored regulatory effects. Trillions in government spending (”investment”) have altered and will alter the entire trajectory and competitive environment of industries engaged in large-scale enterprises and transactions. This removes vast swaths of business activity from free competitive enterprise altogether, and creates displacements and distortions such that the restoration of free enterprise becomes a near-impossible disentanglement.

The result is, after 100 years of big government and seduction of and fusion with big business, the greatest endeavors—from infrastructure to artificial intelligence, from smart cities to space—now consist of “partnerships” with governments rather than free enterprise, at scales and at costs so gigantic they can only be ignored.

Adam Thierer, “‘Japan Inc.’ and Other Tales of Industrial Policy Apocalypse,” Discourse, June 28, 2021.

Perhaps the most ironic indictment of industrial policy punditry lies in the way all the earlier books and essays about Japanese planning not only failed to forecast the many flops associated with it, but also did not foresee China as a potential future economic juggernaut. [. . .] What might that tell us about the ability of experts to predict the future course of countries and economies?

Adam Thierer, “Can Government Reproduce Silicon Valley Everywhere?” Technology Liberation Front, September 12, 2021.

government efforts to artificially try to create regional innovation hubs in a top-down, technocratic fashion will almost certainly persist. As they do, some will argue that this time will be different! Perhaps, but it is more likely that the past is prologue; these new hubs will likely cause federal politicians to jockey for position to have their regions named one of the winners and get a big cut of all the new high-tech pork being served up by Washington.

Weifeng Zhong, “Beijing Can’t Make Sense of Biden’s China Strategy. Can Biden?” Washington Examiner, July 01, 2021.

America is not China, and it would be a fatal mistake to equate competing with China with imitating what China does. Doing so would risk the advantageous U.S. position as the world’s chief innovator, whose ideas are turned into products by vibrant private sectors both domestically and internationally.

Mike Watson, “Industrial Policy in the Real World,” National Affairs, Summer 2021.

Given the nature of industrial policymaking in the United States, there’s little reason to believe future attempts at industrial planning will result in a more coherent, rational, or strategic allocation of resources than they have in the past. [. . .] In short, industrial policy in the United States cannot be steered by a small group of enlightened individuals, because a small group of enlightened individuals will never be at the helm. Indeed, in some sense, there is no single “helm” to speak of.

Samuel Gregg, “Industrial Policy Mythology Confronts Economic Reality,” Law & Liberty, September 3, 2021.

If prizes in policy debates were given out for persistence, those advocating for more widespread use of industrial policy in America would be first in line. No matter how many times it is pointed out that they don’t understand the nature and workings of comparative advantage; or avoid acknowledging how industrial policy fosters rampant cronyism and corruption; or highlight what they consider examples of countries in which industrial policy has been employed successfully (only to have it demonstrated that it didn’t quite work out the way they suggested), they don’t give up.

Elizabeth Nolan Brown, “If This Is How America COMPETES, We’re Going to Lose,” Reason, January 26, 2022.

the bill can’t simply address one main issue or a few critical needs. Instead, it tries to insert the government into every aspect of all sorts of industries and markets and pretend that bureaucrats can solve complex social and cultural issues.

Chang-Tai Hsieh, “Countering Chinese Industrial Policy Is Counterproductive,” Project Syndicate, September 15, 2021.

US political leaders have long tried to counter Chinese industrial policy. And now they seem to have decided that the best way to do that is to emulate it. But their agenda betrays a profound lack of understanding of the unique challenge posed by China’s coupling of an authoritarian political regime with a dynamic market economy.

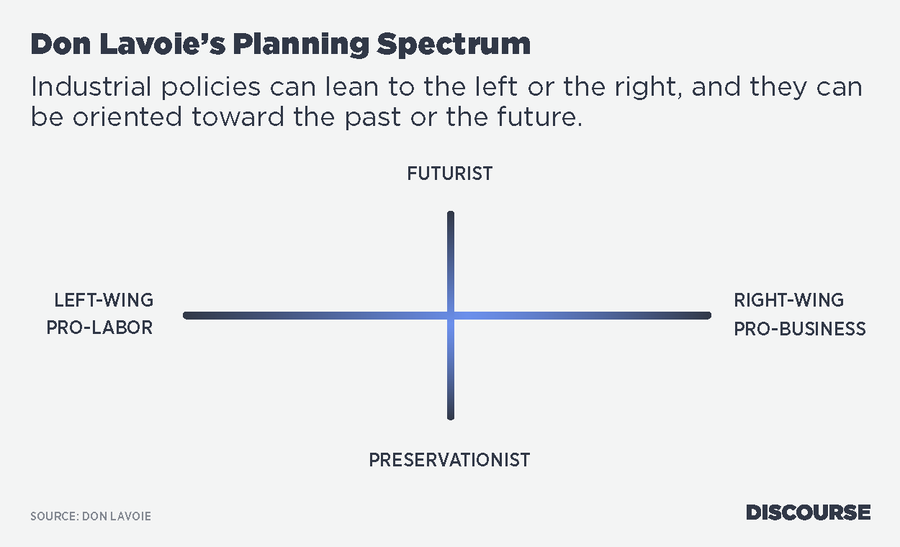

Adam Thierer, “Industrial Policy Advocates Should Learn from Don Lavoie,” Discourse, November 5, 2021.

“In light of the inherent deficiencies of central planning,” Lavoie said, “it might be argued that the U.S. should instead try to reduce current government interference with the competitive process to the absolute minimum consistent with other political goals.” It remains wise advice for today’s policymakers.

Anne O. Krueger, “America’s Muddled Industrial Policy,” CGTN, June 25, 2021.

Governments have a poor track record of identifying “winners” – be it a company or a category of technology – whereas private companies have proved better at transforming new discoveries into new products or cost savings. That is why the U.S. state traditionally has stuck to funding basic research.

Eric Boehm, “Massive Subsidies Won’t Solve the Semiconductor Supply Chain Crisis,” Reason, January 28, 2022.

Tracy C. Miller, “The Case for Limiting Government Semiconductor Subsidies,” The Hill, June 26, 2021.

Without the subsidies, firms would be more cautious about building or expanding foundries. If long-term production capacity is truly insufficient, high prices and anticipated profits give firms the right incentives to build or expand and satisfy demand at cost-covering prices.

Scott Lincicome, “The ‘Endless Frontier’ and American Industrial Policy,” Cato Institute Blog, May 26, 2021.

U.S. industrial policy has a long history of struggling to overcome political pressures, just as public choice predicts, and the EFA is no different. None of this means that all legislating is bad, or that politicians don’t at least occasionally vote in the national interest. Instead, the public choice framework simply adds another hurdle—along with things like the “knowledge problem,” seen and unseen costs, and misaligned incentives—to designing and implementing commercial policies specifically intended to beat the admittedly messy and imperfect situation that the market generates. It’s imperative that we understand these risks before supporting policies that, while they might look good on paper, could easily morph into a counterproductive boondoggle—one we’ve seen countless times with respect to U.S. industrial policy.

Daniel W. Drezner, “Is the United States capable of industrial policy in 2021?” Washington Post, June 14, 2021.

To believe that the United States can pursue a high-caliber industrial policy, however, requires assuming a more competent state than I have seen in the past decade.

Douglas Holtz-Eakin, “The Nicest Thing I Can Write About Supply Chain Policy,” The Daily Dish, June 10, 2021.

Nevertheless, the Senate just passed a provision for $50 billion to subsidize chip fabrication – something the president had requested – and the House will doubtlessly concur. That might seem like an industry victory, but wait until it realizes that the administration will assume it gives it the right to insist on union jobs, micromanage the design of chips, and dictate the pricing and distribution of the products. Good luck with that. As the definitive volume on policy analysis (Benjamin Franklin’s Poor Richard’s Almanack) put it, “He that lieth down with dogs shall rise up with fleas.”

Lipton Matthews, “Industrial Policy—a.k.a. Central Planning—Won’t Make America Great,” Mises Wire, November 5, 2021.

Although industrial policy is in vogue, the evidence suggests that it is not necessary for long-term development. Moreover, despite the popularity of industrial policy in China, America remains the world’s economic power, and by following China, it may lose this vaunted position.

Richard Beason, “Japanese Industrial Policy: An Economic Assessment,” National

Foundation for American Policy, November 2021.

There is no evidence to support the claim that Japanese industrial policy during the 1955-1990 period enhanced growth rates by sector, industries with economies of scale (greater efficiency when produced in increased amounts), productivity growth or “competitiveness.” The reality of the political process and government spending priorities makes it very difficult for such policies to be effective. Furthermore, even if political pressures had not intervened, it seems questionable to suggest that government policymakers would be better than actual market participants in determining the most efficient allocation of resources to produce the best economic outcomes.

Douglas Irwin, “Memo to the Biden administration on how to rethink industrial policy,” Peterson Institute for International Economics, October 2020.

The challenge for policymakers is to identify such industries without succumbing to the notion that every industry is vital to some public objective. For example, the goal of “economic security” is so broadly defined and open-ended that virtually every domestic producer could claim the need for government support on that basis. The risk is that ill-conceived government programs will encourage corrupt behavior in which industries benefit themselves without contributing to national welfare.

Jim Pethokoukis, “Will Biden’s embrace of industrial policy pay off?” AEI Blog, January 15, 2021.

The history of such efforts in advanced capitalist economies gives ample reason for skepticism about the effectiveness of such top-down government planning, from Japanese economic stagnation to the now-mothballed Concorde supersonic jet to France’s failed attempt to create a thriving tech sector. The Internet might seem like the exception that negates the rule, but what turned out to be a successful partnership of government and entrepreneurs didn’t arise out of some master plan from Washington. And what do even the smartest plans look like when filtered through the dodgy quality of American governance? Maybe as an excuse for cronyism and protectionism.

Adam Thierer & Connor Haaland, “Should the U.S. Copy China’s Industrial Policy?” Discourse, March 11, 2021.

America needs to embrace its already vibrant venture capital market, the benefits of basic science and prize competitions, and a light-touch regulatory approach instead of gambling taxpayer dollars on grandiose industrial policy schemes that would likely become boondoggles.

Connor Haaland & Adam Thierer, “Can European-Style Industrial Policies Create Tech Supremacy?” Discourse, February 11, 2021.

Thus far, however, the Europeans don’t have much to show for their attempts to produce home-grown tech champions. Despite highly targeted and expensive efforts to foster a domestic tech base, the EU has instead generated a string of industrial policy failures that should serve as a cautionary tale for U.S. pundits and policymakers, who seem increasingly open to more government-steered innovation efforts.

Phil Levy & Christine McDaniel, “Does the U.S. Need a Vigorous Industrial Policy?” Discourse, February 16, 2021.

we are certainly hearing new enthusiasm these days about industrial policy. It seems to have proponents or converts on both sides of the aisle. This either means that a new consensus has emerged, or it means that the term is being used so loosely that it has lost its original meaning. I’ll go with the latter; it now means different things to different people.

Wall Street Journal columnist Greg Ip discussing why “The traditional skepticism toward industrial policy is well deserved.”

The traditional skepticism toward industrial policy is well deserved. Once Washington starts writing checks for semiconductors, other industries may get in line with the outcome determined more by political clout than economic merit. As in shipbuilding, the targeted companies may end up in perpetual need of federal protection and unable to compete internationally

David Ignatius, “The U.S. is quietly mobilizing its economy against China,” Washington Post, March 4, 2021.

The industrial policy the AI commission recommends could unlock talent and innovation. But if officials aren’t careful, government intervention could also afflict our best companies with the dead weight and dysfunction of our broken political system. We need government to spawn brainpower, not bureaucracy.

Veronique de Rugy, “Support for Industrial Policy is Growing,” AIER, January 18, 2020.

Looking at the federal government today tells me that the problems surrounding R&D programs in the past continue today, and will continue tomorrow, because they are simply a consequence of the normal functioning of government. It is hard to wish these problems away, even in the face of the private sector’s “imperfections.” Those arguing for more funding in R&D should proceed with caution.

This bill is proposing to give money with risk-averse restrictions to a risk-averse organization (the NSF) to be dispersed among other risk-averse organizations (Universities) into a system with increasingly risk-averse incentives. Note that I’m not saying “it’s all fubar’d lets burn it to the ground!” but I am suggesting that instead of slamming on the accelerator, we should be asking “what would a tune-up and an oil change look like instead?”

Ryan Bourne, “Do Oren Cass’s Justifications for Industrial Policy Stack Up?” Cato Commentary, August 15, 2019.

Oren Cass asserts that markets cannot generally allocate resources efficiently by industry. Yet he provides no meaningful metrics to show this is the case, nor shows why his policies would deliver better outcomes. His two main claims about the benefits of a manufacturing sector — “stable employment” and “strong productivity growth” — are directly contradictory. A plethora of evidence suggests as countries’ get richer due to automation and technological improvements, they demand relatively more services, and so the industrial sector declines in employment terms.

Scott Lincicome, “Manufactured Crisis: ‘Deindustrialization, Free Markets, and National Security,” Cato Policy Analysis No. 907, January 27, 2021.

This skepticism—mostly absent from Washington—is indeed warranted: analyses of the U.S. manufacturing sector and the relationship between trade and national security, as well as the United States’ long and checkered history of security‐related protectionism, undermine the theoretical justifications for imposing protectionism and industrial policy in the name of national defense. Instead, open trade, freer markets, and global interdependence will in almost all cases produce better outcomes in terms of national security and, most importantly, preventing wars and other forms of armed conflict.

Matthew Lau, “Trudeau government’s ‘industrial policy’ creates all the wrong incentives,” Toronto Sun, March 16, 2021.

Yet another problem with industrial policy is cronyism. In a free market, businesses earn money by producing goods and services people demand, but when governments give handouts to politically favoured industries, businesses can instead get money by lobbying government for it. Therefore, industrial policy encourages businesses to produce less and lobby more.

If we want a robust economic recovery, we need higher economic productivity. Industrial policy invariably accomplishes the opposite by transferring economic decision-making from the market to politicians and bureaucrats who have less knowledge and weaker incentives to invest productively. The certain effect of the federal government’s economic strategy, therefore, will be to impede recovery rather than hasten it.

Don Boudreaux, “Suffixing Industrial Policy with ‘2.0’ Doesn’t Make It Credible,” AIER, Nov. 18, 2019.

Alberto Mingardi & Deirdre McCloskey, “Not the ‘Entrepreneurial State‘,” AIER, Nov. 2, 2020.

Nils Karlson, Christian Sandström & Karl Wennberg, “Bureaucrats or Markets in Innovation Policy? – A Critique of the Entrepreneurial State,” The Review of Austrian Economics, Vol. 34, No. 1, (April 2020): 81-95.

we identify several deficiencies in the notion of an entrepreneurial state by showing that (i) there is weak empirical support in the many hundreds empirical studies and related meta analyses evaluating the effectiveness of active industrial and innovative policies, that (ii) these policies do not take account of the presence of information and incentive problems which together explain why attempts to address purported market failures often result in policy failures, and that (iii) the exclusive focus on knowledge creation through R&D and different forms of firm subsidies ignores the equally important mechanisms of knowledge dissemination and creation through commercial exploitation in markets.

Matthew D. Mitchell and Adam Thierer, “Industrial Policy is a Very Old, New Idea,” Discourse, April 6, 2021.

The primary problem with the targeted approach to economic development is that it depends on the use of government-granted privileges—discriminatory tax or regulatory relief, cash subsidies, loans and loan guarantees, in-kind donations or the provision of other valuable goods and services. In other words, governments are trying to pick winners.

Judge Glock, “Semiconductors Don’t Need Subsidies,” City Journal, April 20, 2021.

Many economists hoped that the decline of Japanese dominance in semiconductors and in other industries would convince politicians of the folly of state-directed economies. Governments understand neither what they should invest in nor how they should invest in it. If American companies are concerned about their supply chains, by contrast, they have the incentive and funds to move them. Why our federal government wants to take one of America’s most successful industries and turn it into a ward of the state is a mystery.

Judge Glock, “Industrial Policy Hurts Industry,” Washington Examiner, April 20, 2021.

governments keep trying to plan the next big thing. Both the federal government and almost every state have tried to fund biotech clusters. These projects have inevitably ended with weeds growing through parking-lot pavements and trails of corrupt bargains.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.