The Department of Justice has suddenly reversed course from its previous findings that mobile providers who lack spectrum below 1 GHz can become “strong competitors” in rural markets and are “well-positioned” to drive competition locally and nationally. Those supporting government intervention as a means of avoiding competition in the upcoming incentive auction attempt to avoid these findings by highlighting misleading FCC statistics, including the assertion that Verizon owns “approximately 45 percent of the licensed MHz-POPs of the combined [800 MHz] Cellular and 700 MHz band spectrum, while AT&T holds approximately 39 percent.”

Sprint Nextel Corporation (Sprint Nextel) recently sent a letter to the Federal Communications Commission (FCC) signed by Dick Thornburgh, a former US Attorney General who is currently of counsel at K&L Gates, expressing his support for the ex parte submission of the Department of Justice (DOJ) that was recently filed in the FCC’s spectrum aggregation proceeding. The DOJ ex parte recommends that the FCC “ensure” Sprint Nextel and T-Mobile obtain a nationwide block of mobile spectrum in the upcoming broadcast incentive auction. In his letter of support on behalf of Sprint Nextel, Mr. Thornburgh states he believes the DOJ ex parte “is fully consistent with its longstanding approach to competition policy under Republican and Democratic administrations alike.”

Mr. Thornburgh is mistaken. The principle finding on which the DOJ’s new recommendation is based – that the FCC should adopt an inflexible, nationwide restriction on spectrum holdings below 1 GHz – is clearly inconsistent with the DOJ’s previous approach to competition policy in the mobile marketplace. Both the FCC and the DOJ have traditionally found that there is no factual basis for making competitive distinctions among mobile spectrum bands in urban markets, and the DOJ has distinguished among mobile spectrum bands only in rural markets.

In its 2006 complaint against the merger of Alltel and Western Wireless, the DOJ found that, in rural markets with relatively low population densities, it cost more to achieve broad mobile coverage using 1.9 GHz PCS spectrum, which made it less likely that providers with PCS spectrum would deploy in those markets. Based on that finding, the DOJ concluded that additional mobile entry would be difficult in certain rural markets in which the combined firm would own all available 800 MHz Cellular spectrum – the only mobile spectrum below 1 GHz that was available on a nationwide basis at that time.

In that same merger proceeding (I was the FCC Chairman’s wireless advisor at the time), the FCC refused to adopt the DOJ’s rural market distinction and instead maintained its traditional view that spectrum bands above 1 GHz are suitable for the provision of competitive services in both urban and rural markets.

Although the DOJ continued to apply its rural market distinction in subsequent merger reviews (i.e., Alltel/Midwest Wireless and AT&T/Dobson), it recognized that the distinction wasn’t reliably predictive in every rural market and was competitively irrelevant to nationwide competition. For example, in the 2008 Verizon/Alltel merger, the DOJ found that Verizon was a “strong competitor” in rural markets in which Verizon didn’t own any Cellular spectrum below 1 GHz, “because, unlike many other providers with PCS spectrum in rural areas, it has constructed a PCS network that covers a significant portion of the population.” Similarly, in its 2011 complaint against the proposed merger of AT&T and T-Mobile, the DOJ concluded that “T-Mobile in particular” was “especially well-positioned to drive competition, at both a national and local level,” in the mobile market even though T-Mobile owned very little spectrum below 1 GHz at that time.

The DOJ’s new recommendation is a sudden reverse in course from its previous findings that mobile providers who lack spectrum below 1 GHz can become “strong competitors” in rural markets and are “well-positioned” to drive competition locally and nationally.

The DOJ’s sudden reversal is particularly surprising given that the amount of spectrum below 1 GHz has increased substantially since the DOJ adopted its rural distinction in 2006. At that time, the 800 MHz Cellular band was the only spectrum band below 1 GHz that was broadband-capable and fully available on a nationwide basis. Since then, two additional sub-1 GHz spectrum bands capable of supporting mobile broadband services have become available on a nationwide basis – the 800 MHz SMR and 700 MHz bands. Sprint Nextel owns nearly all of the 800 MHz SMR band nationwide, T-Mobile acquired 700 MHz spectrum through its acquisition of MetroPCS this year, and many rural and regional mobile providers own 800 MHz Cellular and 700 MHz spectrum in rural areas across the country.

Those supporting government intervention as a means of avoiding competition in the upcoming incentive auction attempt to avoid these facts by highlighting misleading FCC statistics, including the assertion that Verizon owns “approximately 45 percent of the licensed MHz-POPs of the combined [800 MHz] Cellular and 700 MHz band spectrum, while AT&T holds approximately 39 percent.” This statistic is misleading in two respects.

First, this statistic excludes the 800 MHz SMR band, which is owned almost exclusively by Sprint Nextel. Excluding an entire spectrum band below one gigahertz from the statistical calculation creates the misleading impression that Verizon and AT&T hold a higher percentage of mobile spectrum below 1 GHz than they actually do.

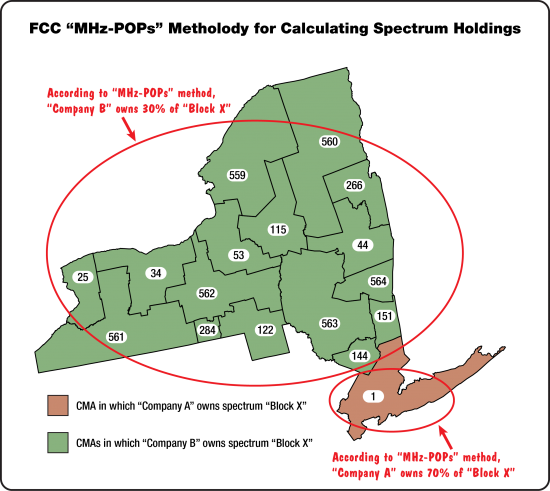

Second, the FCC’s “MHz-POPs” methodology is weighted by population, which skews the resulting percentage of spectrum ownership significantly higher for companies that own spectrum in densely populated urban areas. A hypothetical using this methodology to calculate the percentage of “MHz-POPs” in the Cellular Market Areas (CMAs) covering the State of New York demonstrates just how skewed this methodology can be in the spectrum aggregation context.

Assume that “Company A” and “Company B” both own spectrum “Block X” (i.e., both companies own the same amount of spectrum in absolute terms) in different geographic areas in New York State. Specifically, assume that “Company A” owns “Block X” in geographic license area CMA001 (covering New York City and Newark, New Jersey), and “Company B” owns the same spectrum block in the other sixteen CMAs, including all six rural license areas in the state. If their spectrum holdings are calculated using the FCC’s population-weighted “MHz-POPs” methodology, “Company A” holds 70 percent of the “Block X” spectrum and “Company B” holds only 30 percent. (For an explanation of this methodology, see the “Technical Appendix” at the bottom of this post.)

As this example demonstrates, analyzing the percentage of spectrum mobile providers hold on a nationwide basis using the FCC’s “MHz-POPs” methodology is particularly misleading given the DOJ’s determination that spectrum below 1 GHz is competitively relevant only in sparsely populated rural areas. For example, if the FCC were to adopt a rule prohibiting any one mobile provider from holding 50% or more of the spectrum below 1 GHz in New York State on a “MHz-POPs” basis, “Company A” would be in violation of the rule even though it holds spectrum in only 1 market and doesn’t hold any spectrum in rural markets.

When the 800 MHz SMR band is included and spectrum holdings are evaluated on a market-by-market basis, at least four different mobile providers hold spectrum below 1 GHz in most markets – a result that wasn’t even possible in 2006 (absent nationwide spectrum disaggregation on the secondary market) when the DOJ adopted its rural distinction.

Mr. Thornburgh’s broad statements about the DOJ’s past approach to competition policy generally and the FCC’s skewed statistics are not legitimate, data-based substitutes for a detailed analysis of DOJ precedent and current spectrum holdings below 1 GHz in both urban and rural markets. A detailed analysis indicates that the DOJ’s new recommendation is not “fully consistent” with its previous approach to competition in the mobile marketplace, though it is consistent with a desire to rig the spectrum auction to favor certain competitors.

Technical Appendix

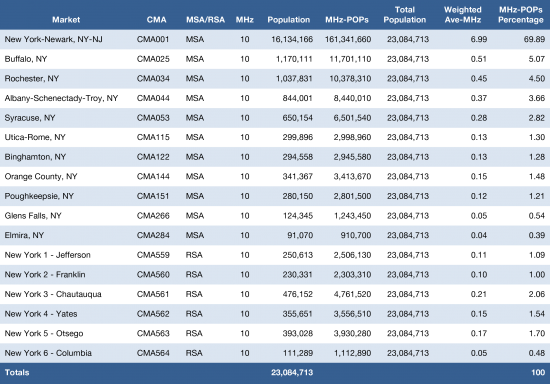

The FCC calculates “MHz-POPs” by multiplying the megahertz of spectrum held by a mobile provider in a given area by the population of that area.

The FCC also weights spectrum holdings by population using a “population-weighted average megahertz” calculation. The FCC calculates the nationwide “population-weighted average megahertz” of a mobile provider by dividing that provider’s “MHz-POPs” (as calculated above) by the US population.

The calculations for the New York State example in this blog post use “Cellular Market Areas,” which consist of Metropolitan Statistical Area (MSA) and Rural Service Area (RSA) licenses as defined by the FCC in Public Notice Report No. CL-92-40, “Common Carrier Public Mobile Services Information, Cellular MSA/RSA Markets and Counties,” DA 92-109, 7 FCC Rcd. 742 (1992). The population figures are from the 2000 U.S. Census, U.S. Department of Commerce, Bureau of the Census.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.