By Larry Downes & Geoffrey A. Manne

Published in BNA’s Daily Report for Executives

The FCC published in June its annual report on the state of competition in the mobile services marketplace. Under ordinary circumstances, this 300-plus page tome would sit quietly on the shelf, since, like last year’s report, it ‘‘makes no formal finding as to whether there is, or is not, effective competition in the industry.’’

But these are not ordinary circumstances. Thanks to innovations including new smartphones and tablet computers, application (app) stores and the mania for games such as ‘‘Angry Birds,’’ the mobile industry is perhaps the only sector of the economy where consumer demand is growing explosively.

Meanwhile, the pending merger between AT&T and T-Mobile USA, valued at more than $39 billion, has the potential to accelerate development of the mobile ecosystem. All eyes, including many in Congress, are on the FCC and the Department of Justice. Their review of the deal could take the rest of the year. So the FCC’s refusal to make a definitive finding on the competitive state of the industry has left analysts poring through the report, reading the tea leaves for clues as to how the FCC will evaluate the proposed merger.

Make no mistake: this is some seriously expensive tea. If the deal is rejected, AT&T is reported to have agreed to pay T-Mobile $3 billion in cash for its troubles. Some competitors, notably Sprint, have declared full-scale war, marshaling an army of interest groups and friendly journalists.

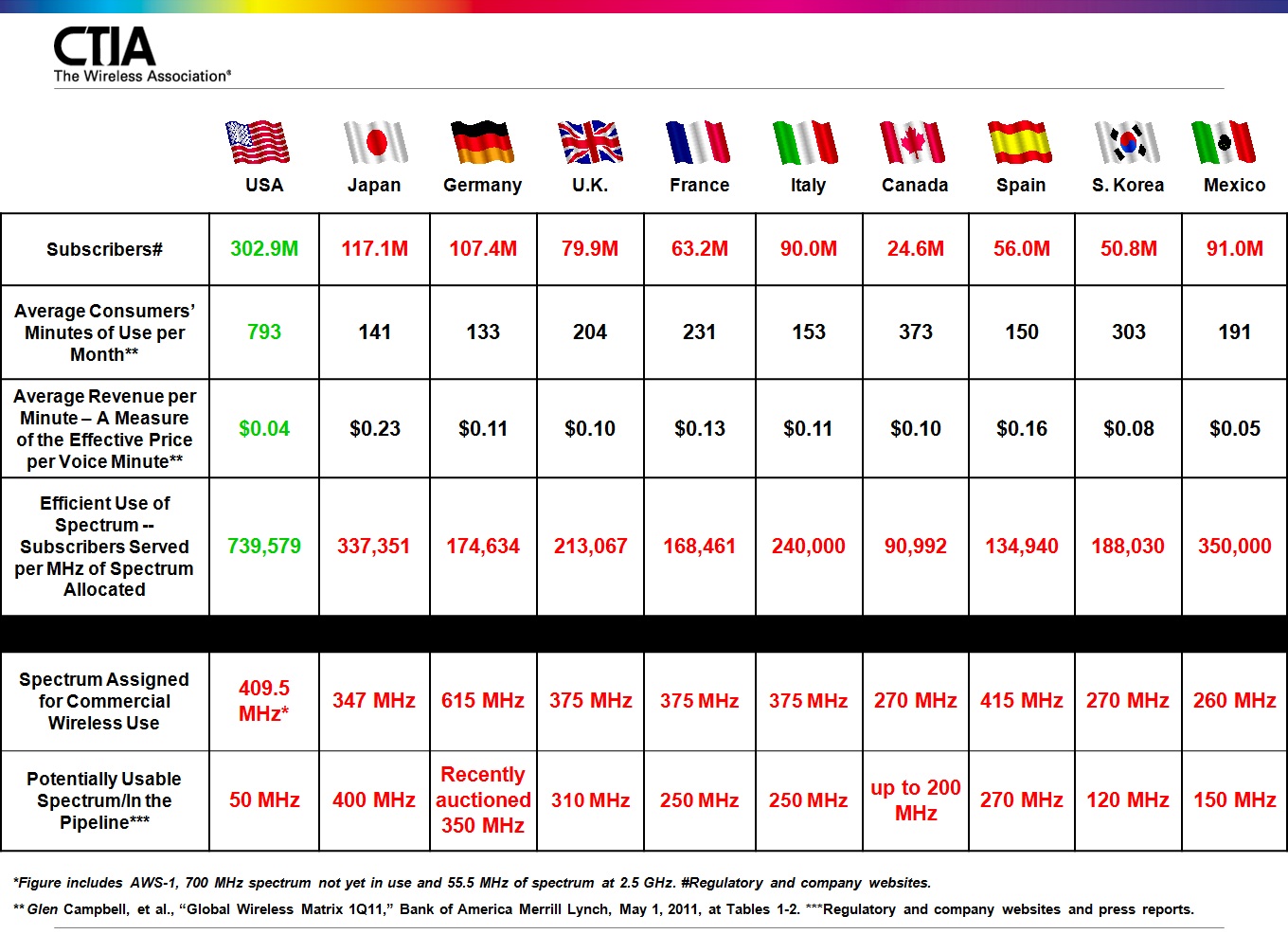

But the deal makes good economic sense for consumers. Most important, T-Mobile’s spectrum assets will allow AT&T to roll out a second national 4G LTE (longterm evolution) network to compete with Verizon’s, and expand service to rural customers. (Currently, only 38 percent of rural customers have three or more choices for mobile broadband.)

More to the point, the government has no legal basis for turning down the deal based on its antitrust review. Under the law, the FCC must approve AT&T’s bid to buy T-Mobile USA unless the agency can prove the transaction is not ‘‘in the public interest.’’ While the FCC’s public interest standard is famously undefined, the agency typically balances the benefits of the deal against potential harm to consumers. If the benefits outweigh the harms, the Commission must approve. Continue reading →

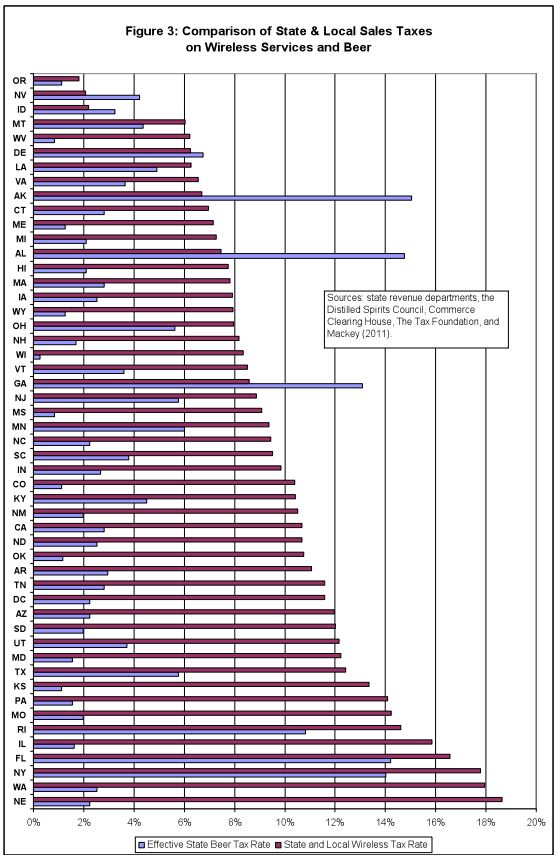

For CNET this morning, I have a long article reviewing the sad recent history of how local governments determine the quality of mobile services.

For CNET this morning, I have a long article reviewing the sad recent history of how local governments determine the quality of mobile services.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.