TLF blogger and Heritage Foundation senior fellow James Gattuso gets his 15 seconds of fame — or at least 9 seconds — in this recent clip that appeared on the “Tonight Show with Jay Leno.” Probably not the sort of media impact he was looking for, but I bet he’ll take it!

At the last possible moment before the Christmas holiday, the FCC published its Report and Order on “Preserving the Open Internet,” capping off years of largely content-free “debate” on the subject of whether or not the agency needed to step in to save the Internet.

At the last possible moment before the Christmas holiday, the FCC published its Report and Order on “Preserving the Open Internet,” capping off years of largely content-free “debate” on the subject of whether or not the agency needed to step in to save the Internet.

In the end, only FCC Chairman Julius Genachowski fully supported the final solution. His two Democratic colleagues concurred in the vote (one approved in part and concurred in part), and issued separate opinions indicating their belief that stronger measures and a sounder legal foundation were required to withstand likely court challenges. The two Republican Commissioners vigorously dissented, which is not the norm in this kind of regulatory action. Independent regulatory agencies, like the U.S. Courts of Appeal, strive for and generally achieve consensus in their decisions. Continue reading →

In case you missed it, Saturday Night Live recently mocked the news media’s habit of inciting techno-panics (and any other panic they can).

Enjoy. After the fear-inspiring ad…

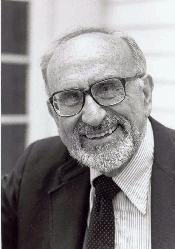

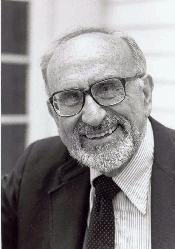

I was very sad to learn this morning of the death of Alfred Kahn, the brilliant economist known as “the father of airline deregulation.” He was 93. He was a brilliant, gracious and gregarious man who never failed to have a smile on his face and make those around him smile even more. He will be missed.

I was very sad to learn this morning of the death of Alfred Kahn, the brilliant economist known as “the father of airline deregulation.” He was 93. He was a brilliant, gracious and gregarious man who never failed to have a smile on his face and make those around him smile even more. He will be missed.

Kahn has been an inspiration to an entire generation of regulatory analysts and economists. His 2-volume masterwork, The Economics of Regulation, has served as our bible and provided us with a framework to critically analyze the efficacy of government regulation. I have cited it in more of my papers and essays than any other book or article. The book was that big of a game-changer, as was Kahn’s time in government. A self-described “good liberal Democrat,” Kahn was appointed by President Jimmy Carter to serve as Chairman of the Civil Aeronautics Board in the mid-1970s and promptly set to work with other liberals, such as Sen. Ted Kennedy, Stephen Breyer, and Ralph Nader, to dismantle anti-consumer cartels that had been sustained by government regulation. These men understood that consumer welfare was better served by innovative, competitive markets than by captured regulators, who talked a big game about serving “the public interest” but were typically busy stifling innovation and market entry.

His academic and policy achievements were significant, but what I will most remember about him is that, in a field not known for lively personalities or exciting discussions, Kahn was a consistent source of great wit and entertainment. He always managed to make even the most dreadfully boring of regulatory topics interesting and entertaining. Everyone would go away happy from a Fred Kahn talk. Moreover, in a policy arena characterized by bitter intellectual bickering and endless bad-mouthing, Kahn always rose above the fray and held himself out to be a model of maturity and respectfulness. I have never heard a single person say a bad word about Alfred Kahn. Not one. That’s saying something in the field of regulatory policy! Continue reading →

Recent media attention has resurrected the notion that criminal background checks for online dating sites are helpful and should even be required by law. Sunday’s front page article in the New York Times described how companies selling background checks can “unmask Mr. or Ms. Wrong.” And today’s Good Morning America featured a segment called “Online Dating: Are you Flirting with a Felon?”

I was interviewed by both the Times and Good Morning America to say that these background checks are superficial, create a false sense of security, and that government should never mandate these for online dating sites. First of all, I should say that I’m personally involved in this issue. I met my wife on Match.com. We didn’t screen each other, at least not for a criminal past. I remember doing a simple search on her screen name however, and for a while thinking she could be someone who she wasn’t, though.

I was interviewed by both the Times and Good Morning America to say that these background checks are superficial, create a false sense of security, and that government should never mandate these for online dating sites. First of all, I should say that I’m personally involved in this issue. I met my wife on Match.com. We didn’t screen each other, at least not for a criminal past. I remember doing a simple search on her screen name however, and for a while thinking she could be someone who she wasn’t, though.

But for fun, I did a postmortem background check on myself, just to see what my now wife would have seen. First, I went to Intelius and spent $58 (warning: there’s a constant barrage of confusing upsells) to see criminal, civil judgment, property, name, telephone and social networking data. The result: nothing harmful thankfully! But also nothing particularly helpful, either. And the report included a family member that isn’t, and left out my brother that is. Then I went to MyMatchChecker and ordered the basic level screening (the two most expansive products–“Getting Serious” and “All About Me”–require social security numbers, which I doubt most people will not learn about the other until they actually get married). The site made it easy to not include all relevant info, and I didn’t, so there’s a delay on my check. But let’s assume it’s all good too (ahem).

So would my wife have used the absence of a negative history to assume I was a good person? Well, she shouldn’t have. Although these criminal screenings can help in some situations, they still have some serious shortcomings. They result in false negatives when criminal records don’t appear or may not include felony arrests that were plead down to misdemeanors.

And these sort of criminal screenings are not very inclusive–at all. Continue reading →

[Note: This post is updated regularly as I discover relevant old or new material.]

“Regulatory capture” occurs when special interests co-opt policymakers or political bodies — regulatory agencies, in particular — to further their own ends. Capture theory is closely related to the “rent-seeking” and “political failure” theories developed by the public choice school of economics. Another term for regulatory capture is “client politics,” which according to James Q. Wilson, “occurs when most or all of the benefits of a program go to some single, reasonably small interest (and industry, profession, or locality) but most or all of the costs will be borne by a large number of people (for example, all taxpayers).” (James Q. Wilson, Bureaucracy, 1989, at 76).

While capture theory cannot explain all regulatory policies or developments, it does provide an explanation for the actions of political actors with dismaying regularity. Because regulatory capture theory conflicts mightily with romanticized notions of “independent” regulatory agencies or “scientific” bureaucracy, it often evokes a visceral reaction and a fair bit of denialism. (See, for example, the reaction of New Republic’s Jonathan Chait to Will Wilkinson’s recent Economist column about the prevalence of corporatism in our modern political system.) Yet, countless studies have shown that regulatory capture has been at work in various arenas: transportation and telecommunications; energy and environmental policy; farming and financial services; and many others.

I thought it might be useful to build a compendium of quotes from various economists and political scientists who have studied the regulatory process throughout history and identified regulatory capture or client politics as a major problem. I would greatly appreciate having others suggest additional quotes and studies to add to this list since I plan to update it frequently and eventually work all of this into a future paper or book. [Note: I have updated this compendium over a dozen times since the original post, so please check back for updates.]

The following list is chronological and begins, surprisingly, with the thoughts of progressive hero Woodrow Wilson…

Continue reading →

The Sixth Circuit ruled on Tuesday that criminal investigators must obtain a warrant to seize user data from cloud providers, voiding parts of the notorious Stored Communication Act. The SCA allowed investigators to demand providers turn over user data under certain circumstances (e.g., data stored more than 180 days) without obtaining a warrant supported by probable cause.

The Sixth Circuit ruled on Tuesday that criminal investigators must obtain a warrant to seize user data from cloud providers, voiding parts of the notorious Stored Communication Act. The SCA allowed investigators to demand providers turn over user data under certain circumstances (e.g., data stored more than 180 days) without obtaining a warrant supported by probable cause.

I have a very long piece analyzing the decision, published on CNET this evening. See “Search Warrants and Online Data: Getting Real.” (I also wrote extensively about digital search and seizure in “The Laws of Disruption.”) The opinion is from the erudite and highly-readable Judge Danny Boggs. The case is notable if for no other reason than its detailed and lurid description of the business model for Enzyte, a supplement that promises to, well, you know what it promises to do…. Continue reading →

I’m very pleased to announce that I am today joining the Mercatus Center at George Mason University as a Senior Research Fellow. I will be working in the Mercatus Center’s Technology Policy Program and covering many of the same issues I have been active on for many years now, including: free speech and child safety issues; privacy and advertising policy; communications and media law; Internet governance; online taxation and e-commerce regulation; and much more.

I’m very pleased to announce that I am today joining the Mercatus Center at George Mason University as a Senior Research Fellow. I will be working in the Mercatus Center’s Technology Policy Program and covering many of the same issues I have been active on for many years now, including: free speech and child safety issues; privacy and advertising policy; communications and media law; Internet governance; online taxation and e-commerce regulation; and much more.

I’m particularly excited about joining Mercatus since it reunites me with my old Cato colleague Jerry Brito, who also blogs with me here at the TLF, of course. Jerry is also a senior research fellow at Mercatus and he has done a stellar job developing the Technology Policy Program at the Center. I very much look forward to working closely with him, my old friend Jerry Ellig, and the many other skilled intellectuals working in various programs throughout Mercatus. It’s an amazing group of scholars Mercatus has assembled and I know I have much to learn from all of them.

For those not familiar with the Mercatus Center, it was founded in 1985 and has become the world’s premier university source for market-oriented ideas. As its website notes, Mercatus is a university-based research center that aims to bridge the gap between academic ideas and real world problems: Continue reading →

Tim Wu appears hell-bent of redefining the English language. After reading his new book, The Master Switch: The Rise and Fall of Information Empires [See my 6-part review: 1, 2, 3, 4, 5, 6] and his new editorial in today’s Wall Street Journal, “In the Grip of the New Monopolists,” it’s clear to me that he has made it his mission in life to redefine some rather basic, widely-accepted economic terms to suit his own political purposes. Among them: “market power,” “monopoly,” and “laissez-faire.” I addressed his misuse of the term “market power” here and misunderstanding of the term “laissez-faire” here.

In today’s Journal editorial, it’s “monopoly” that Wu seeks to redefine. He begins his essay by asking: “How hard would it be to go a week without Google? Or, to up the ante, without Facebook, Amazon, Skype, Twitter, Apple, eBay and Google?” He continues on to suggest that these “new monopolists” have an iron lock on their respective markets and that there appears little hope of escaping them.

But the problem with his argument that “we are living in an age of large information monopolies” begins with the fact that he speaks of “monopolies” in a plural sense and apparently misses the irony of that entirely. If so many “information monopolies” exist, then Wu’s thesis is undermined by the very fact that no one company dominates the Internet landscape. What Wu is really suggesting is that the Digital Economy landscape is littered with dominant firms in industry sectors that he has defined extremely narrowly. Continue reading →

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.