It was an awfully bad snowfall that paralyzed Washington, DC last week. And though we may curse Old Man Winter, ‘tis still the season for snow. Unfortunately, it’s also the season for a flurry of bad legislation – and we’re already trying to dig-out the Internet from a pile of bad proposed state and federal laws.

It was an awfully bad snowfall that paralyzed Washington, DC last week. And though we may curse Old Man Winter, ‘tis still the season for snow. Unfortunately, it’s also the season for a flurry of bad legislation – and we’re already trying to dig-out the Internet from a pile of bad proposed state and federal laws.

So far this year there have been hundreds of bills introduced nationwide, many that impact the Internet. That’s why today NetChoice released its first iAWFUL list of 2010, taking stock of the most serious legislative threats facing the global Internet.

The Internet Advocates’ Watchlist for Ugly Laws (iAWFUL) is our top ten – or more accurately, “bottom ten” – list of the worst proposed Internet laws in America. We have Congress and 16 states represented on our list (the same bad bills often spread to multiple states).

Our #1 iAWFUL bill is a Congressional bill (HR4173) that would expand the FTC’s rulemaking power. Buried in the 1700 pages plus of the Wall Street Reform and Consumer Protection Act of 2009 is a four page amendment to the FTC Act that would dramatically increase the FTC’s rulemaking authority. This expansion would mean the removal of significant procedural safeguards that have existed for the past thirty-five years. Given the aggressively pro-regulatory statements made by FTC officials on privacy and online media, expanded powers could do serious damage to online services and Internet innovation. Reporter Grant Gross wrote a good article recapping the issue here.

#2 on the iAWFUL list are the advertising nexus bills in Colorado (SB 1193), Illinois (SB 3353), Maryland (SB 824), New Mexico (HB 50), Virginia (SB 660) and Vermont (HB 661). These bills declare that some forms of Internet advertising are equivalent to having sales agents in their states. All these states want to force out-of-state advertisers to collect and remit sales tax on sales to their residents. These nexus bills are popping up everywhere, whack-a-mole style.

Check out #3 – #10. Hopefully DC is done for the year with snow. Regardless, I’ll still need my snow shovel to help dig the Internet out from a blizzard of bad legislation.

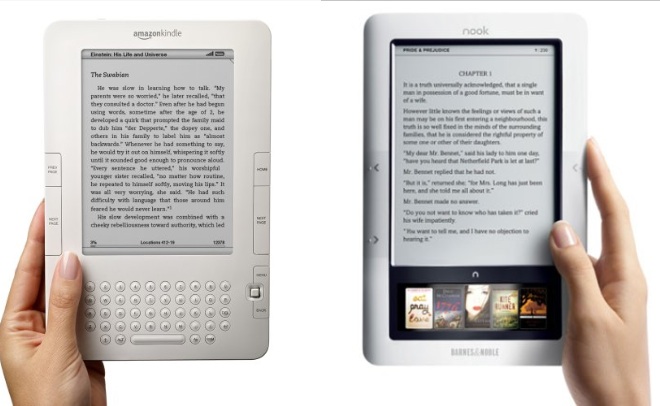

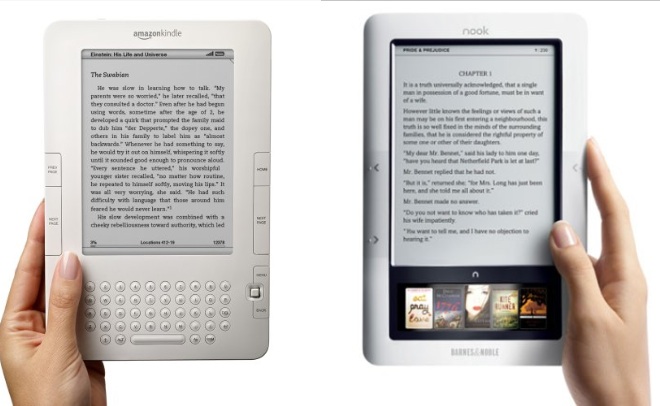

Business Insider reports that, sometime next year, Scribd will launch a “seamless” interface that allows users to access Scribd docs on their Kindles. That’s a major step forward for the startup, which aims to be the “YouTube for print”—and which Adam and I use to make all our PFF papers available online in an embeddable Flash viewer that’s much quicker to load than the full PDFs. But it also represents a serious potential long-term challenge to Amazon, since Scribd is “quietly developing a strong e-book storefront to match its hoard of user generated content,” as Business Insider notes, and because:

If Scribd can put its books on the Kindle, this number should only grow, especially since it offers publishers a better business deal than Amazon. Amazon reportedly offers a 50/50 sales split. Scribd only keeps 20% and allows publishers to set their own price.

So much for “The coming Kindle monopoly” the cranks over at Oligopoly Watch warn us about!

It would be more accurate to say that Scribd will be “Kindling” e-book competition within the base of Kindle users, and of course, competing devices like Barnes & Noble’s Nook offer cross-platform competition, just as satellite television competes with cable. In both cases, the platform operator has a strong incentive to compete for users by offering as much content (books/video programming) as possible at attractive prices.

It would be more accurate to say that Scribd will be “Kindling” e-book competition within the base of Kindle users, and of course, competing devices like Barnes & Noble’s Nook offer cross-platform competition, just as satellite television competes with cable. In both cases, the platform operator has a strong incentive to compete for users by offering as much content (books/video programming) as possible at attractive prices.

On the one hand, one might say that inter-platform competition is stronger in the case of video delivery platforms, because users generally lease equipment on a month-to-month basis, while e-book users must buy their $250+ device up-front (making it therefore harder to switch from Amazon to Barnes & Noble, if one decides one doesn’t like the offerings or prices for e-books on the Kindle). But on the other hand, if Scribd can compete head-to-head with Amazon in offering e-books on Amazon’s Kindle (and perhaps on the Note, too, someday soon), users don’t need to switch devices at all: They can just switch e-book providers. Furthermore since e-books are bought on an à la carte basis, users don’t have to switch completely, they can just switch for any particular book—meaning that Amazon needs to compete for every additional purchase they can get, which means lower prices and more choices for consumers.

Continue reading →

I’ve ranted in past blog posts about the inconvenience of Ticketmaster’s paperless tickets and have even called them the highway to ticket hell (a nod to AC/DC’s paperless tickets use). I’m in a ranting mood again today, particularly when I was thinking about how they’d frustrate a Christmas gift to my parents for a play or show (my parents love attending concerts & theater).

Ticketmaster may call it innovation, but I call it frustration. You can resell your townhouse, Toyota, or textbooks online. But there’s one product, that thanks to new technology, can’t be bought and resold–“paperless tickets“.

That almost anything can be bought and resold is a benefit to consumers, particularly in tough economic times. But with paperless tickets, instead of getting a paper ticket (or an email that you print up at home) you have to present 1) the credit card used to purchase the tickets, and 2) a government-issued photo identification for admittance. Paperless tickets have been used throughout the recent Miley Cyrus tour this year. She performed at the Verizon Center last month in Washington, DC and a local news story reported on the hardship it created for many fans:

A photo ID is also required, meaning Talia Levin couldn’t just take her mom’s credit card to the concert. Her mom had to swipe her through. “If you are older, then you can go by yourself, so it’s hard to have to go with your parents,” stated Talia Levin. “I refuse to buy into any artist who does this ever again,” said Talia’s mom, Melanie Levin. “I won’t do it.”

So what if I wanted to go online to buy concert tickets for my parents as a Christmas Gift? Would I have to go down to the arena to get them in–down in Atlanta?? Continue reading →

The U.S. Treasury and the Federal Reserve have pushed back the deadline for banking industry compliance with regulations pursuant to the Unlawful Internet Gambling Enforcement Act of 2006 (UIGEA). UIGEA, the controversial tack-on to the Bush administration’s SAFE Port Act aimed at curtailing on-line gambling by making it illegal for U.S banks and financial institutions to participate in funds transactions between U.S. citizens and corporations that operate online casinos, effectively banning Internet gambling.

In a joint statement, the Treasury and the Fed delayed the compliance date, which had been set for today (December 1) to June 1, 2010, the Gambling Today blog reports. The decision also comes just days before Thursday’s scheduled hearing in the House Financial Services Committee on H.R. 2267, a bill introduced by Rep. Barney Frank (D-MA), which would overturn UIGEA and create a full licensing and regulatory framework for the Internet gambling industry in the United States.

As Financial Services Committee chairman, Frank has been a vocal opponent of UIGEA and has been working for its repeal over the past two years. In authorizing the delay, the two agencies said that financial institutions were not prepared with the mechanisms they needed to block unlawful Internet gambling transactions, but they also noted that the rules did not provide a clear definition of unlawful Internet gambling. This last observation could be significant as it acknowledges one of the bill’s principal vulnerabilities—it broadly defines Internet gambling as games of chance. Opposition groups, notably the Poker Players Alliance, have repeatedly argued (correctly IMHO) that certain online casino games, especially poker, are games of skill.

Online gambling blogs generally greeted the delay positively and hope it is another step in the direction of restoring the freedom to gamble online.

As the Gambling Today blog notes:

The postponement was greatly appreciated by the supporters of online gambling. House Financial Services Committee chairman Barney Frank has two of his sponsored bills coming up for hearing on December 3. Frank said, “This will give us a chance to act in an unhurried manner on my legislation to undo this regulatory excess by the Bush administration and to undo this ill-advised law.”

I wrote here a couple of months ago about the shady practice among a few Internet retailers of handing off customers who accept a “special offer” to a company that charges people a monthly fee for some kind of credit monitoring service. And I argued hopefully that maybe technologists and the Internet community could generate a response to this problem:

Being a smart, informed, and aggressive consumer is each person’s responsibility if a free market is to operate well. The alternative is a negative feedback loop in which government authorities protect us, we rely on that protection and stop policing retailers. Thereby we abandon the field of consumer protection to government authorities, who—try as they might—can never do as good a job for us as we can for ourselves.

The Senate Commerce Committee is having a hearing today on “Aggressive Sales Tactics on the Internet and Their Impact on American Consumers.”

CNET reports that Amazon has halted plans to sell wine online. The reason: too many inconsistent state laws. Per the article:

Since the Supreme Court ruled in May 2005 that states must grant the same shipping rights to out-of-state and in-state wineries, winery-to-consumer shipping has become legal in 35 states, according to wine advocacy group Free the Grapes. But state laws governing direct wine shipping vary greatly, creating an onerous task in managing compliance.

Amazon has become a great marketplace for countless products–it’s a shame to see wine makers shut out from this market due to regulatory barriers to e-commerce.

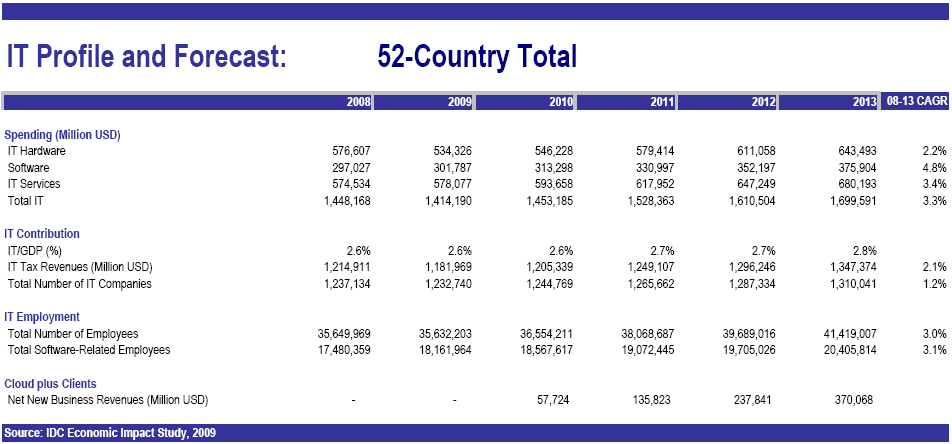

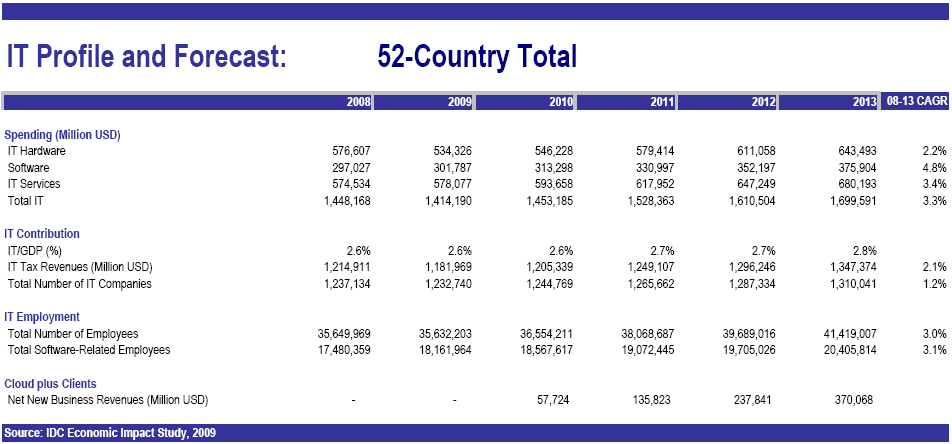

This Microsoft-funded study projects that, by 2013, cloud computing will have added $800 billion in net new business revenues for the 52 countries surveyed (over 2009 levels). The growing economic importance of the cloud is likely to increase pressure for government involvement. As President Reagan said: “Government’s view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.”

Adam Thierer and I have warned that neutrality regulation, once imposed on broadband providers, will extend to other Internet services wherever “gatekeepers” are alleged to control access to a platform used by others. In short, the slippery slope of creeping common carriage is real and we’re already heading down it, with cyber-collectivist “luminaries” like Jonathan Zittrain and Frank Pasquale demanding neutrality regulation for devices, application platforms like iTunes and Facebook, and search!

TLF Reader Jim Reardon made a particularly astute observation on my post asking whether Americans really want net neutrality regulation:

Regulation of any service, product or industry is preceded by definition. Once defined, it is subject to taxation.

[Net Neutrality regulation] is a prelude to taxation of Internet products and services. It will likely start with telephony services and proceed accordingly to financial services, and continue from there.

As such, the activity is essentially neutral insofar as technology innovation is concerned — so long as applicable taxes are paid the government will ensure that the service is not disfavored by the network operators.

Absolutely right! One of the greatest barriers to government regulation and taxation of the Internet today is the lack of clear definitions: The FCC rules will tell you precisely what “cable television” or “commercial radio” mean, but the concepts of “social networking,” “Internet video,” “blogging,” and even “search” are indeterminate and constantly evolving.

Ronald Reagan once quipped:

Government’s view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.

Fortunately, government’s ability to implement this view depends—to paraphrase President Clinton—”on what the meaning of the word ‘is’ ‘it’ is”: Allowing “it” to remain beautifully amorphous may be the best way to keep government at bay.

My colleague Jim Harper and I have been having a friendly internal argument about Internet privacy regulation that strikes me as having potential implications for other contexts, so I thought I might as well pick it up here in case it’s of interest to anyone else. Unsurprisingly, neither of us are particularly sanguine about elaborate regulatory schemes—and I’m sympathetic to the general tenor of his recent post on the topic. But unlike Jim, as I recently wrote here, I can think of two rules that might be appropriate: A notice requirement that says third-party trackers must provide a link to an ordinary-language explanation of what information is being collected, and for what purpose, combined with a clear rule making those stated privacy policies enforceable in court. Jim regards this as paternalistic meddling with online markets; I regard it as establishing the conditions for the smooth functioning of a market. What do those differences come down to?

First, a question of expectations. Jim thinks it’s unreasonable for people to expect any privacy in information they “release” publicly—and when he’s talking about messages posted to public fora or Facebook pages, that’s certainly right. But it’s not always right, and as we navigate the Internet our computers can be coaxed into “releasing” information in ways that are far from transparent to the ordinary user. Consider this analogy. You go to the mall to buy some jeans; you’re out in public and clearly in plain view of many other people—most of whom, in this day and age, are probably carrying cameras built into their cell phones. You can hardly complain about being observed, and possibly caught on camera, as you make your way to the store. But what about when you make your way to the changing room at The Gap to try on those jeans? If the management has placed an unobtrusive camera behind a mirror to catch shoplifters, can the law require that the store post a sign informing you that you’re being taped in a location and context where—even though it’s someone else’s property—most people would expect privacy? Current U.S. law does, and really it’s just one special case of the law laying down default rules to stabilize expectations. I think Jim sees the reasonable expectation in the online context as “everything is potentially monitored and archived all the time, unless you’ve explicitly been warned otherwise.” Empirically, this is not what most people expect—though they might begin to as a result of a notice requirement. Continue reading →

Thanks to Adam for the kind introduction; for folks to whom I’m unfamiliar, my Ars Technica archive has the bulk of my tech writing over the past year and change, though plenty of it is straight reporting now well past its expiration date. It’s been suggested that for openers, I crosspost last week’s Cato @ Liberty thumbsucker on behavioral advertising regulation, which riffs on some of the commentary here, but in the interest of avoiding redundancy, I’ll just do the digest version and let the curious click through. Since they say the first day in lockup, you should pick a fight with the biggest mofo in the yard, I’ll excerpt the part where I disagree with Berin a bit:

First, while it’s certainly true that there are privacy advocates who seem incapable of grasping that not all rational people place an equally high premium on anonymity, it strikes me as unduly dismissive to suggest, as Berin Szoka does, that it’s inherently elitist or condescending to question whether most users are making informed choices about their privacy. If you’re a reasonably tech-savvy reader, you probably know something about conventional browser cookies, how they can be used by advertisers to create a trail of your travels across the Internet, and how you can limit this. But how much do you know about Flash cookies? Did you know about the old CSS hack I can use to infer the contents of your browser history even without tracking cookies? And that’s without getting really tricksy. If you knew all those things, congratulations, you’re an enormous geek too — but normal people don’t. And indeed, polls suggest that people generally hold a variety of false beliefs about common online commercial privacy practices. Proof, you might say, that people just don’t care that much about privacy or they’d be attending more scrupulously to Web privacy policies — except this turns out to impose a significant economic cost in itself.

I still end up rejecting most of the proposed arguments for regulation, though a couple of the suggested rules (notice requirement, liquidated damages for intentional breach of stated privacy policy) struck me as more defensible, if not especially urgent.

That aside, I want to get down to the more important business of suggesting a TLF theme song: The Magnetic Fields’ sardonic “Technical (You’re So)” (whence the title of this post), in which wordsmith/crooner Stephin Merritt delivers such lines as: “There are no papers on you / The laws don’t cover what you do / You and your think-tank entourage / Are all counterculture demigods” and “You’re a Libertarian / The death of the left was you / You look like Herbert Von Karajan / You live underneath the zoo.” Sure, they’re meant as mockery when Merritt sings them, but then, “queer” used to be a pejorative too. Reappropriation, baby.

Also, rhyming “Libertarian” with “Von Karajan” is the greatest act of poetry in music since Sting paired “He starts to shake and cough” with “the old man in / that book by Nabakov.” Fact.

It was an awfully bad snowfall that paralyzed Washington, DC last week. And though we may curse Old Man Winter, ‘tis still the season for snow. Unfortunately, it’s also the season for a flurry of bad legislation – and we’re already trying to dig-out the Internet from a pile of bad proposed state and federal laws.

It was an awfully bad snowfall that paralyzed Washington, DC last week. And though we may curse Old Man Winter, ‘tis still the season for snow. Unfortunately, it’s also the season for a flurry of bad legislation – and we’re already trying to dig-out the Internet from a pile of bad proposed state and federal laws.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.