In April I had the opportunity to testify before the House Small Business Committee on the costs and benefits of small business use of Bitcoin. It was a lively hearing, especially thanks to fellow witness Mark T. Williams, a professor of finance at Boston University. To say he was skeptical of Bitcoin would be an understatement.

Whenever people make the case that Bitcoin will inevitably collapse, I ask them to define collapse and name a date by which it will happen. I sometimes even offer to make a bet. As Alex Tabarrok has explained, bets are a tax on bullshit.

So one thing I really appreciate about Prof. Williams is that unlike any other critic, he has been willing to make a clear prediction about how soon he thought Bitcoin would implode. On December 10, he told Tim Lee in an interview that he expected Bitcoin’s price to fall to under $10 in the first half of 2014. A week later, on December 17, he clearly reiterated his prediction in an op-ed for Business Insider:

I predict that Bitcoin will trade for under $10 a share by the first half of 2014, single digit pricing reflecting its option value as a pure commodity play.

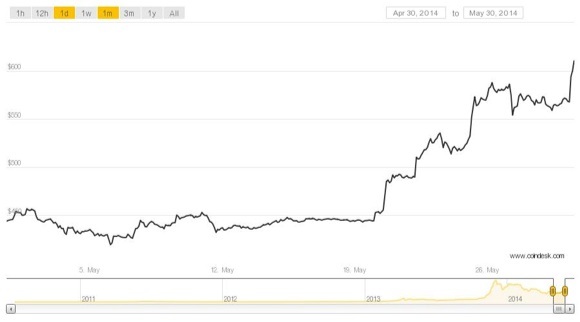

Well, you know where this is going. We’re now five months into the year. How is Bitcoin doing?

It’s in the middle of a rally, with the price crossing $600 for the first time in a couple of months. Yesterday Dish Networks announced it would begin accepting Bitcoin payments from customers, making it the largest company yet to do so.

None of this is to say that Bitcoin’s future is assured. It is a new and still experimental technology. But I think we can put to bed the idea that it will implode in the short term because it’s not like any currency or exchange system that came before, which was essentially William’s argument.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.