In the upcoming issue of Harvard Business Review, my colleague Paul Nunes at Accenture’s Institute for High Performance and I are publishing the first of many articles from an on-going research project on what we are calling “Big Bang Disruption.”

In the upcoming issue of Harvard Business Review, my colleague Paul Nunes at Accenture’s Institute for High Performance and I are publishing the first of many articles from an on-going research project on what we are calling “Big Bang Disruption.”

The project is looking at the emerging ecosystem for innovation based on disruptive technologies. It expands on work we have done separately and now together over the last fifteen years.

Our chief finding is that the nature of innovation has changed dramatically, calling into question much of the conventional wisdom on business strategy and competition, especially in information-intensive industries–which is to say, these days, every industry.

The drivers of this new ecosystem are ever-cheaper, faster, and smaller computing devices, cloud-based virtualization, crowdsourced financing, collaborative development and marketing, and the proliferation of mobile everything. There will soon be more smartphones sold than there are people in the world. And before long, each of over one trillion items in commerce will be added to the network.

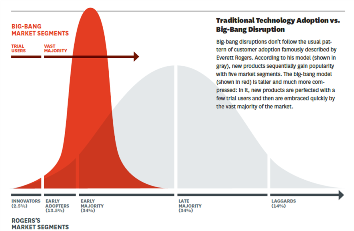

The result is that new innovations now enter the market cheaper, better, and more customizable than products and services they challenge. (For example, smartphone-based navigation apps versus standalone GPS devices.) In the strategy literature, such innovation would be characterized as thoroughly “undiscplined.” It shouldn’t succeed. But it does.

So when the disruptor arrives and takes off with a bang, often after a series of low-cost, failed experiments, incumbents have no time for a competitive response. The old rules for dealing with disruptive technologies, most famously from the work of Harvard’s Clayton Christensen, have become counter-productive. If incumbents haven’t learned to read the new tea leaves ahead of time, it’s game over.

The HBR article doesn’t go into much depth on the policy implications of this new innovation model, but the book we are now writing will. The answer should be obvious.

This radical new model for product and service introduction underscores the robustness of market behaviors that quickly and efficiently correct many transient examples of dominance, especially in high-tech markets.

As a general rule (though obviously not one without exceptions), the big bang phenomenon further weakens the case for regulatory intervention. Market dominance is sustainable for ever-shorter periods of time, with little opportunity for incumbents to exploit it.

Quickly and efficiently, a predictable next wave of technology will likely put a quick and definitive end to any “information empires” that have formed from the last generation of technologies.

Quickly and efficiently, a predictable next wave of technology will likely put a quick and definitive end to any “information empires” that have formed from the last generation of technologies.

Or, at the very least, do so more quickly and more cost-effectively than alternative solutions from regulation. The law, to paraphrase Mark Twain, will still be putting its shoes on while the big bang disruptor has spread halfway around the world.

Unfortunately, much of the contemporary literature on competition policy from legal academics is woefully ignorant of even the conventional wisdom on strategy, not to mention the engineering realities of disruptive technologies already in the market. Looking at markets solely through the lens of legal theory is, truly, an academic exercise, one with increasingly limited real-world applications.

Indeed, we can think of many examples where legacy regulation actually makes it harder for the incumbents to adapt as quickly as necessary in order to survive the explosive arrival of a big bang disruptor. But that is a story for another day.

Much more to come.

Related links:

- “Creating a ‘Politics of Abundance’ to Match Technology Innovation,” Forbes.com.

- “Why Best Buy is Going out of Business…Gradually,” Forbes.com.

- “What Makes an Idea a Meme?“, Forbes.com

- “The Five Most Disruptive Technologies at CES 2013,” Forbes.com

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.