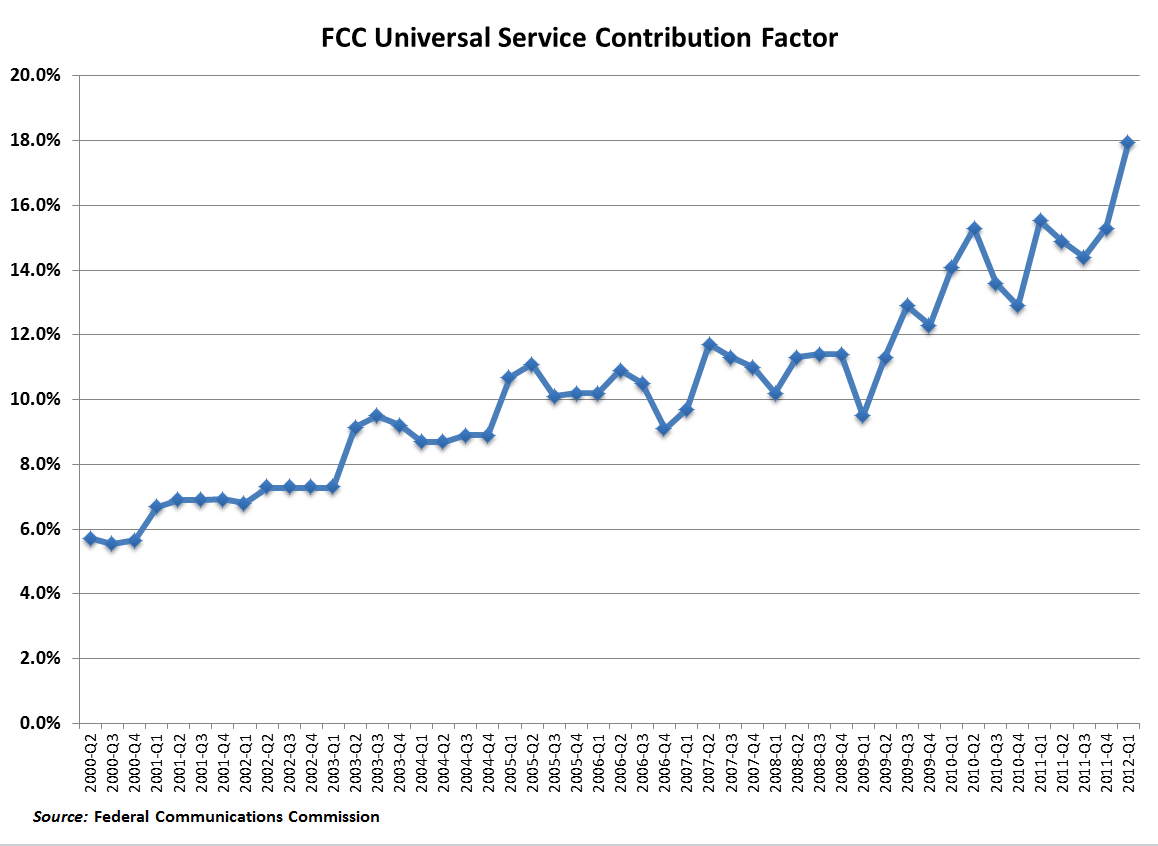

The FCC’s universal service tax is officially out of control. The agency announced yesterday that the “universal service contribution factor” for the 1st quarter of 2012 will go up to 17.9%. This “contribution factor” is a tax imposed on telecom companies that is adjusted on a quarterly basis to accommodate universal service programs. The FCC doesn’t like people calling it a tax, but that’s exactly what it is. And it just keeps growing and growing. In fact, as the chart below reveals, it has been exploding in recent years. It was in single digits just a few years ago but is now heading toward 20%. And not only is this tax growing more burdensome, but it is completely unsustainable. As the taxable base (traditional interstate telephony) is eroded by new means of communicating, the tax rate will have to grow exponentially or the base will have to be broadened to cover new technologies and services. We should have junked the current carrier-delivered universal service subsidy system years ago and gone with a straight-forward voucher system. A means-tested voucher could have targeted assistance to those who needed it without creating an inefficient, unsustainable hidden tax like we have now. For all the ugly details, I recommend reading all of Jerry Ellig’s research on the issue.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.