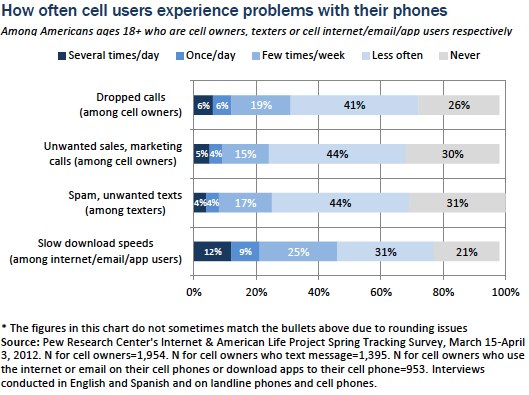

Some 77 percent of wireless phone users who use their phones for online access say slow download speeds plague their mobile applications, according to a new survey from the Pew Internet and American Life Project. Of the same user group, 46 percent said they experienced slow download speeds at least once a week or more frequently (see chart below).

While the report, published last week, does not delve into the reasons behind the service problems, it does offer evidence that users are noticing the quality issues wireless congestion is creating. Slow download speeds are a function of available bandwidth for mobile data services. Bandwidth requires spectrum. The iPhone, for instance, uses 24 times as much spectrum as a conventional cell phone, and the iPad uses 122 120 times as much, according to the Federal Communications Commission FCC Chairman Julius Genachowski. As more smartphones contend for more bandwidth within a given coverage area, connections slow or time out. Service providers and analysts have warned that the growing use of wireless smartphones and tablets, without an increase in spectrum, would begin to degrade service. There have been plenty of anecdotal instances of this. Pew offers some quantitative measurement.

While technologies such from cell-splitting to 4G offer temporary fixes, the quality issue will not be fully addressed until the government frees up more spectrum. While the FCC hasn’t helped much by blocking the AT&T-T-Mobile merger and joining with the Department of Justice in delaying the Verizon deal to lease unused spectrum from the cable companies, at least the agency has acknowledged the problem. Right now, as Larry Downes reported last week, the National Telecommunications and Information Agency (NTIA), which has been charged with the task of identifying spectrum the government can vacate, is stalling. It would be nice to see the FCC apply the aggressiveness it brings to industry regulation to getting NTIA off the schneid. At the same time, the Commission needs to put aside its ideological bent and do what it can to make more spectrum available in the short term.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.

The Technology Liberation Front is the tech policy blog dedicated to keeping politicians' hands off the 'net and everything else related to technology.